By Stewart Urist

In 2022, I assumed a new role that required rebuilding a nonprofit’s financial systems and procedures. Amid the uncertainty of the pandemic, the company experienced a few years of rapid turnover in the finance department. Working with the one remaining part-time staffer and sparse documentation, it was quickly apparent that while the organization had many needs, the highly limited accounting system was a major source of inefficiency. Given the system’s limited reporting and data integration, outside tools were being used for everything from creation of financial statements to AP documentation. As I staffed the department back up and rebuilt financial procedures, I also began to evaluate replacement systems. In June of 2023 we began our migration to Sage Intacct, and by September, we were live in the new software.

This wasn’t the only path for us — on the road to Sage, we evaluated a few different systems, most notably Dynamics GP, NetSuite, and AccountingWare. Any of these three could have met our company’s needs, but the web-based application, wide range of integration possibilities, reporting flexibility, and the fact that two other major arts groups in our area had already migrated to the system made it the right choice for our needs. In this review, I’ll highlight a few of the key functionalities of Sage Intacct that have improved our daily workflow and the quality of the financial information available, as well as flag some pitfalls to keep in mind along the way.

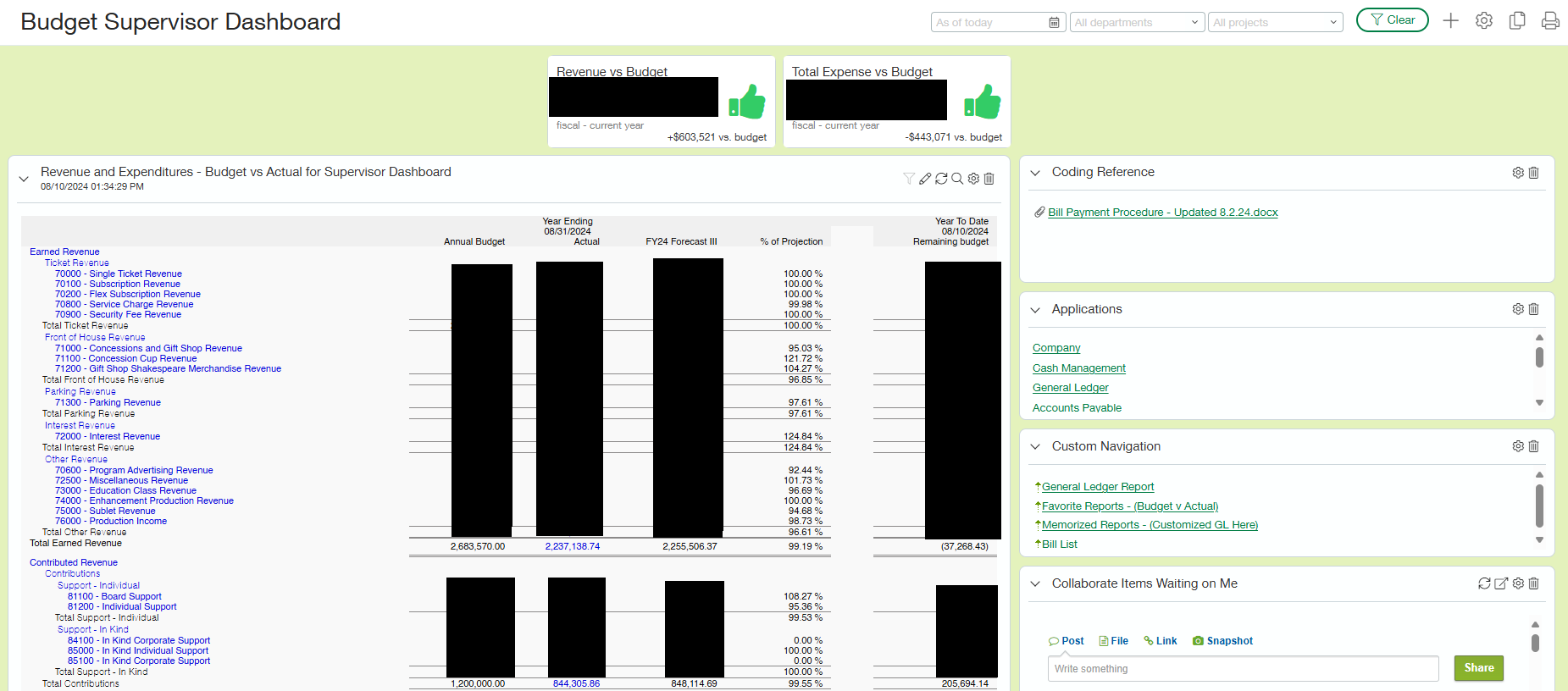

Intacct Dashboard for Supervisors

Implementation and Cost

Like many SAAS offerings, Sage Intacct representatives work with you to identify the right set of modules for your organization’s needs. The software is structured such that you receive access to a core set of modules, and advanced versions of modules and functionality can be added on for additional cost. Besides module selection, the other main driver of cost is the number of users who need access and at what level. Each “business user” able to log transactional data adds annual cost, and “employee users” which have a mostly view-only level of access. We have four business users and a ten-pack of employee users for our department’s heads and other key budget supervisors. The one thing we liked about our previous system was the cost, which was in the low thousands annually. Sage Intacct is approximately ten times more expensive with our suite of modules.

Sage Intacct works with a few different implementing companies, and they try to be thoughtful in matching clients with firms that have industry experience. We were partnered with Armanino, a large accounting firm, and were specifically assigned to a team that had just completed an implementation for an opera company and which had some familiarity with our CRM Tessitura. The base understanding of the performing arts and of our core business software made our fast implementation a lot smoother. We found them to be excellent partners through the setup process. Do be careful as your specifications are transferred to the implementing firm and codified in a statement of work. We had a small misunderstanding about how much historical information would be transferred from our old software, and while we eventually caught the oversight, it required a small change order to make the adjustment.

Onboarding and Training

We received software training at the same time, and we prepared spreadsheet after spreadsheet for our implementing firm’s structuring and importing data from our old system. Armanino leads their own classroom-style training courses, and a pack of “seats” for our financial team was included as part of our implementation package. All subscribers receive basic access to Sage University – a library of training videos and help documents maintained by Intacct. We elected to add on a “learning membership” which unlocks the broader library of videos and structures them into courses, very helpful for onboarding new staff into the software. Subscribers also have access to the Sage Community. Both service tickets and general knowledge sharing with the wider Intacct community are found in this space. Finally, from the help & support dropdown available in the navigation bar, “help on this page” can also be selected, taking users to product documentation for the current feature or screen.

Quarterly software updates, group webinars, and limited support from a designated contact are also included with any subscription. Both Armanino and Intacct sought to sell us an additional support package with more on-demand product support options, however, we felt we were unable to take on the expense in addition to the significant increase in cost we already experienced transitioning to the software. Thus far, the free and lower-cost options previously mentioned have met our onboarding and ongoing training needs.

Web-based application

At the time of migration, our company was also transitioning away from physical IT infrastructure, and it was important we avoid any solution that would require us to maintain on-site servers or manage our own software updates. Systems typically accomplish this in one of two ways:

Provider Hosted Access: The accounting software is hosted on infrastructure owned by the system’s provider and accessed by users via a remote desktop client. This frees the client from maintaining their own servers, but issues with dropped connections, and quality of life matters like window resizing and difficulty interfacing with files on a user’s local machine make hosted environments suboptimal.

Web Access: A growing number of systems, including Sage Intacct, are now fully web-based. This makes access as simple as navigating to a login page and doesn’t require any special setup beyond multi-factor authentication. Although accessing via a PC is most appropriate, basic functions such as approvals or viewing simple reports and dashboards can be accomplished on a tablet or mobile device with minimal hassle. Creating another instance of the software to reference multiple pages or modules is as straightforward as duplicating a browser tab.

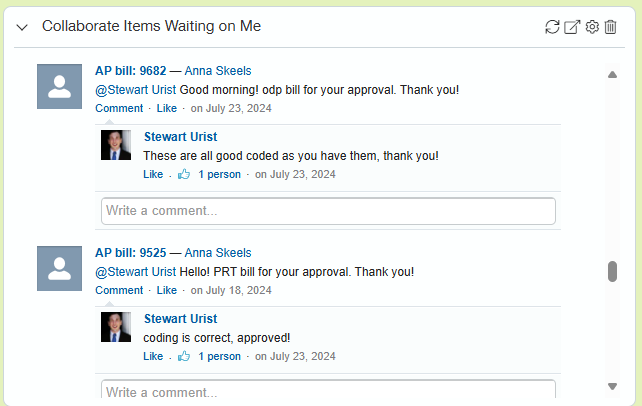

Sage Intacct has some additional quality-of-life improvements that come from its web-based DNA. Its reports can be accessed in an HTML5 version that is drillable via hyperlinked numbers and fields all the way down to individual journal entries or AP/AR entries. Though many systems allow drilldown, the speed of the system and simplicity of emailing these reports to other users of the system are major points of convenience. It is also designed to have deep integrations with salesforce.com, a web-based CRM system used in a wide range of industries, and customized into packages like Patron Manager for use in performing arts venues. While our company uses Tessitura as its CRM, some of those underlying functions, such as the “collaboration” functionality that allows commenting and tagging of other users throughout the system, is very helpful for limiting the amount of accounting communication handled via email.

Collaboration Function Allows Commenting and Tagging Other Users

Bank Feed

Most contemporary accounting systems have some bank feed functionality allowing them to connect directly to a business’ bank accounts and import transactions for a variety of purposes. Our legacy system could only accomplish this with a CSV import, so this was an area especially appreciated by my team. Once configured, the previous day’s bank transactions began flowing into Intacct at 9 a.m. each day. Once imported, Intacct can engage with them for a few key purposes:

Centralized bank data: Simply having all our activity accessible in one place is a major efficiency. Rather than logging into our bank account directly we can navigate to “bank transactions” within Intacct’s Cash Management module. Transactions can be filtered and searched by account, amount, description, and several other dimensions.

Bank reconciliations: Once the bank feed is configured in Sage Intacct, the bank reconciliation interface changes so that users have access to two tabs – one for the bank, and one for Intacct. Matches can be initiated from either side, but generally, we work from the bank. If a bank item doesn’t have a corresponding entry, it’s simple to write the appropriate journal entry from within the reconciliation interface.

Matching and Creation Rules: By the time we open the bank reconciliation module, most of our bank reconciliation is already completed because we’ve written a series of rules, or basically simple automations, that read the bank feed data both as it comes in and whenever the reconciliation module is loaded.

Creation rules write a journal entry, such as when interest is deposited into one of our accounts or when we transfer funds between two accounts.

Matching rules seek out Intacct activity that can be attributed to a bank feed item, such as matching check numbers cut out of the AP module to items that clear the bank.

It’s worth noting that compatibility with bank feeds is dependent on your financial institutions. One of our accounts does not have the functionality, so we still perform a manual reconciliation of the account each month. Luckily, it only has a handful of transactions, and it’s a quick process. As of the time of this article, our record for reconciling all our accounts with the help of our matching and creation rules is 4 hours. Prior to our migration, it rarely took us less than a month, due to the complicated nature of some of our revenue recognition processes.

Import Bank Transactions Directly Into Intacct

Reporting

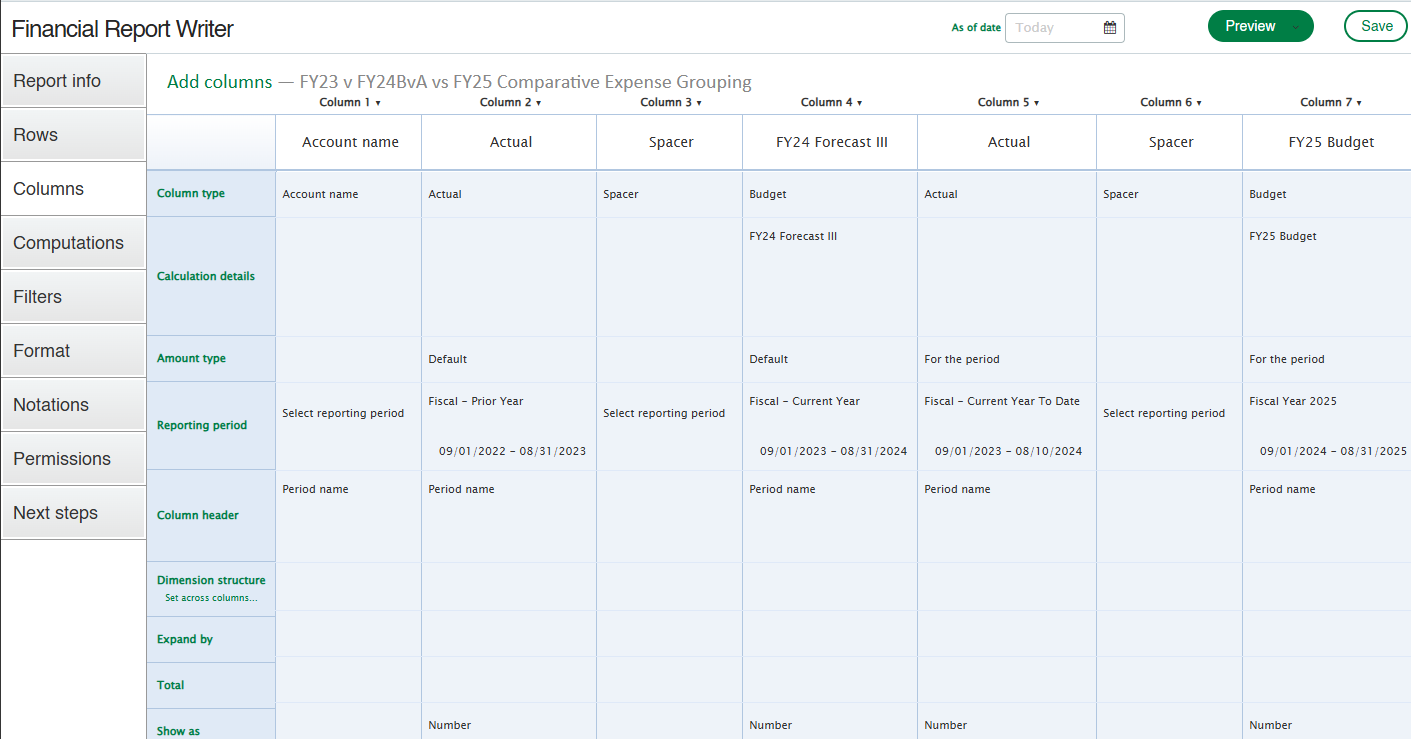

Sage Intacct’s reporting module is one of the areas in which we have realized the most significant improvements. Our previous system’s reporting was so inflexible that we were forced to export our data to Excel to prepare financials. Even with a written procedure, the potential for error and time spent reconciling the various statements was considerable. Since migrating to Sage Intacct, producing board-ready financial reports after a period has been closed is as simple as a few clicks.

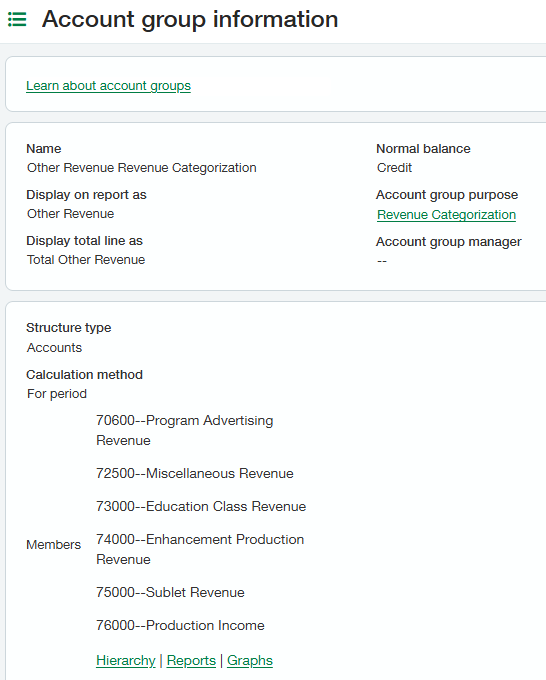

It did take an initial investment of time both with and without our implementation firm. Intacct reporting is oriented around user-defined groups of activity. When accounts are added to the system, one of the fields you define is its “Quick Start Category.” These are broad families of activity such as earned revenue, foundation support, inventory expense, or current assets. Sage Intacct has several out-of-the-box reports built around these categories, meaning that you can expect to have some basic reporting options on day one. The Quick Start Categories can also be remapped during implementation, for example, we didn’t have any use for the “Gaming Revenue” category, so we remapped it to become our line for Concessions Revenue.

Define Groups of Accounts

Where Sage Intacct shines, however, is its capability for deeper customization in reporting. Users can define groups of accounts and even groups of groups of accounts depending on presentation needs. Other dimensions can also have custom groupings as well, for example, we’ve defined groups of our department codes that correspond to our functional areas. All our typical account groupings and variance columns are configured right in the report builder, so no additional work is needed post-export for presentation purposes. Furthermore, the reports are highly drillable, which makes it simple to investigate any areas of interest. The rich formatting options allow for the addition of footer notes, different fonts, colored text, and even building in the company logo to the header.

The built-in report writer is intuitive, and its help documentation, both in the platform and in Sage University, is rich. The system is built with data visualization in mind as well, and most financial reports can also be configured to run as financial graphs. Reports can be scheduled, emailed by the system, and are accessible to anyone with access to the software, not just the “business users” who can log accounting transactions. Finally, reports and graphs can be added to dashboard views, along with several other kinds of modules, structuring routine data into an at-a-glance format that can be especially helpful for non-accounting consumers. We set up a simple dashboard for our budget supervisors that shows budget vs actuals in dollars, outstanding AP approvals, and links to key documentation.

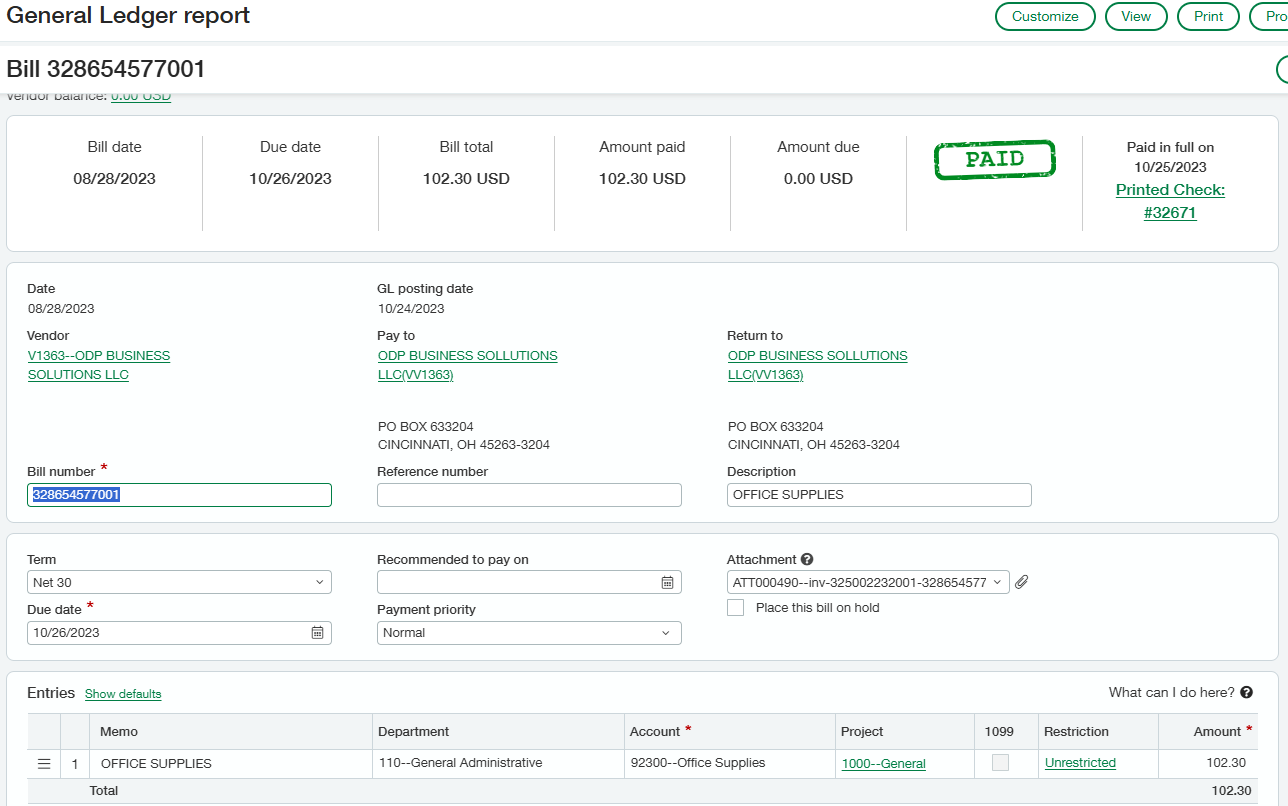

Drillable General Ledger Report

Accounts Payable

Intacct’s AP workflows is another area that significantly improved our day-to-day processes. In our Intacct setup, bills go through a few key steps:

Entry – Sage’s bill entry looks very similar to other systems, allowing for coding and various other dimensional input, descriptions for both the bill and individual line detail, and selection of different document and posting dates.

Pay Bills – All entered bills can be found on this screen for individual selection. The interface displays the current bank balance (per the AP account ledger) and allows the selection of payment by ACH, Check, or preference as set on the vendor file. Bills paid by cash or external transfer can also be marked as paid through this menu.

Approve Payments – Sage Intacct also allows approvals after bill entry, but we have our approval phase in this step. A supervisor views each payment request and verifies appropriate coding and approvals are applied per organizational policies.

Print Checks / ACH File Generation – Checks can be printed in a variety of preprinted and blank formats, and voiding and re-issuance is straightforward. ACH File Generation and confirmation occur as two separate steps, allowing for correction of any errors discovered at the time of bank upload.

Sage Intacct’s flexibility means that different organizations may create more robust or simplified workflows. An organization with a large accounting staff servicing multiple subsidiaries might require a more formal integrated purchasing process and additional levels of approval. Intacct includes a robust purchasing module included in its base package that is not part of my company’s implementation. On the other hand, a small company may determine that its financial controls would be better served by a process focused more on duty segregation than approvals.

Pay Bills, Approve Payments and Print Checks

Budgeting and Forecasting

Budgets can be loaded into Intacct in a couple of different ways: The system allows line-by-line entry, but this is onerous for anything but the most minor adjustments. The budget can also be accepted by the system as a CSV data import. While imports into systems can always be a little fiddly, Sage eases the process by providing downloadable templates outlining the required fields and structure.

We decided to pay extra for access to Sage Intacct Planning (SIP) – formerly a third-party integration that Sage acquired. This cloud-based budget platform would need a full review of its own to provide in full detail, but we have found it significantly easier to work with and much less error-prone than our legacy Excel budgeting sheets.

Company account dimensions can be imported from Intacct, and finance staff can either build out the lines themselves or help the software set up an initial layout through a wizard-style interface.

The system is built for collaboration without any of the version control issues that plague Excel budgeting. The budget owner can invite other budget supervisors as collaborators to add their own numbers. Invitations can also be configured such that only a small slice of the budget is available to an individual user as a matter of focusing their attention or limiting access to sensitive information.

We chose to build our budget line-by-line, as we used to do in Excel, but used as intended; some lines can be set up as formulas / derived figures. For example, instead of building out individual wage and FICA lines, you can build out different wage and benefit rates for employees or groups of like employees. The system can then map the pieces of their compensation to the appropriate accounting lines, focusing attention time on the staffing footprint rather than breaking out the individual dollars.

SIP can be used to generate future financial statements based on input data, cash forecasts, and dashboards. Most importantly, the budgets can be pushed directly to Intacct without the possibility of import errors, and then the updated budgets (or forecasts) are immediately available for reporting purposes. Where previously we would only import into our accounting system as a last step in any budgeting or forecasting work, it’s painless to do this in an ongoing way, and using the powerful reporting module, we review the impact of any changes by comparing them against previous forecasts, our original budget, and prior year actuals.

Compare Budget, Forecasts, and Actuals with Reporting Feature

Conclusion

After about a year into our Sage Intacct migration, my company has realized such a wide array of benefits that, even with the greatly increased annual cost, the return on investment has made it worthwhile. Our staff has untapped potential in the software which will allow us to realize further improvement, and possibly offset the increased expense of the software through automation and further process streamlining. Watching the quarterly release notes, the opportunities in the accounting space from AI have not been lost on the Intacct development team, and they are starting to build AI assist functionality into the AP and other modules to aid coding and flag possible entry errors.

Before undertaking your own migration, I would recommend speaking with another company that has already made the transition. Intacct will make introductions upon request, and we were aware of some local arts organization already on the software who were kind enough to provide a hands-on demo. Sage Intacct is a very robust platform, and for smaller companies, a tool like QuickBooks may provide more than enough functionality at a fraction of the cost. Be clear-eyed on your needs, rather than just your wants or what the sales team is pushing.

Finally, if you do migrate, take time with your implementation, if possible. We had to shift in a rush to make the start of our new fiscal year, but given a few more months, we probably would have maximized the opportunity that transition presents to revisit ledger codes and flesh out processes. As with any major technology shift, up-front planning and change management work will pay dividends in both the quality of your implementation and the experience of your users.