By: Reese Lamping, Kai Ling Liu, Jai Ta, Hongyun Yu, Ziqi Zhou

The following article provides a context of Live Service Gaming as part of a research study conducted as a capstone team in the Master of Entertainment Industry Management at Carnegie Mellon University. Part II focuses on LSG audience data and context.

Characterized by evolving content and gameplay, live service games (LSGs), have become a dominant force in the gaming industry and are essential to any developer’s roster. In Q3 of fiscal year 2023, game publisher, Electronic Arts Games reached $1.95 billion USD in net revenue with LSGs such as Apex Legends and The Sims 4 accounting for 73% of that total, reporting that a vast portion of the company’s earnings came from their live service titles (Mejia, 2024).

The strategic pressure to develop more LSG titles is rising. It was reported in February 2024 that 66% of studios agree that LSGs are necessary for long-term success (Zwiezen, 2024). However, the market has become oversaturated with LSG titles fighting for market share. As a result, both meeting rising consumer expectations and increased market competition have presented challenges in maintaining player retention. Data from leading game developers such as Electronic Arts Games, miHoYo, and Psyonix showcase declining player bases in popular LSG titles like Apex Legends, Genshin Impact and Rocket League. The growth for LSG titles is in a downturn, highlighting that players can no longer devote time and energy to games, much less, one title (Kaser, 2024).

The core issues with player retention stem from the following: “ballooning development and user acquisition costs, user fatigue and monetization, post COVID-19 revenue declines, a slowdown in ‘hot trends’ like the BR boom, [and] mobile franchise expansions are not delivering expected returns” (Francis, 2023, para. 9).

Many leading companies are committed to the monetization model of generating revenue through in-game purchases, often referred to as microtransactions. However, while LSGs remain profitable, their player bases are declining. Battle royale (BR) games, games that reward the last player standing, are one of the most popular game styles for LSGs. In one telling example of gamer fatigue, leading BR game Apex Legends dropped 44% of its player count on Steam from February 2023 to December 2023 (Reeves, 2023). While microtransactions are a main component of LSGs, they are also one of several key factors that contribute to decreased player counts, as “many users seem to feel that the game prioritizes its monetization models, rather than improving the gameplay experience itself” (Black, 2024, para. 8).

Industry conditions drive the need to implement best practices for successful marketing campaigns that mitigate player falloff and ensure long-term player engagement.

Research Questions

This research focuses on insights from game developers, content creators, and players, specifically analyzing consumer behaviors and preferences, to uncover best practices for engaging and retaining LSG players across the industry. Key research questions included:

1. What are the key elements of successful game campaigns that drive player engagement and retention?

2. How do content and monetization models contribute to player engagement?

3. How do market conditions and saturation affect the success of existing LSGs?

Due to the plethora of LSGs available, player expectations for seamless game functionality and attention-grabbing content has increased. Likewise, as microtransactions plague the LSG model, players are questioning whether the value proposition for developers and publishers lies in player experience and community, or profitability (Chung, 2023). Market saturation and increasing familiarity with the LSG format are driving churn. Overall, the LSG market requires more timely and strategic maneuvers from developers, mainly because “there is so much content available out in the world” (esport executive, personal communication, October 23, 2023).

Image Source: RDNE Stock, Pexels

Background

Live service games are often serviced instantaneously by providing evolving content, features, and experiences to players. In 2024, LSGs dominated the U.S. video game market share with “about 70% of the market going towards free-to-play (F2P) LSGs” (esports executive, personal communication, January 28, 2024). LSGs have redefined the traditional barriers of gaming and have risen to prominence by being more player-centric as “[LSGs are] always getting new downloadable content (DLC) and in-game content. The use of online and live content is important and the game publishers that regularly keep their users up-to-date, do the best” (digital marketing executive, personal communication, October 23, 2023).

Game companies have been shifting towards the LSG model due to their ability to foster robust community interaction. However, given that the majority of gamers only play one or two games in a given month, this pivot has seen an increase in market saturation and content fatigue (Gresham, 2023). Market competition and the increasing pressure from consumer expectations call for innovative player retention strategies.

Newzoo, a global leader in game data, reports that growth for LSGs will decelerate in 2024 due to user time constraints, emphasizing that gamers have less time to devote to games in general, much less more than one LSG title (Kaser, 2024). Market saturation is making it increasingly difficult for developers to sustain a player’s time spent in a single game. In 2023, Steam (the largest online game distributor) saw a staggering release of over 12,000 new games, a stark increase from the 312 games released in 2010 (Clement, 2024). In an interview with the research team, one gaming executive shared:

Every LSG is competing with past LSGs [...] they don’t listen to their communities and as such, new entrants are in the ecosystem, and players will eventually break and go somewhere else. There are only so many games that can exist at the same time.

Data from SNJ Insights shows that “eight out of every 10 players decided to move on from a F2P LSG within eight weeks since launch [...] when nothing major launched to directly challenge the game. Gamers simply decided they had played enough and moved on” (Naji, 2024, para. 3). As the industry predicts a decline in the LSG landscape, the key to sustained success lies in not just releasing new content, but also in fostering meaningful connections with and amongst players to deliver experiences that resonate beyond a game.

Previous Work in the Field

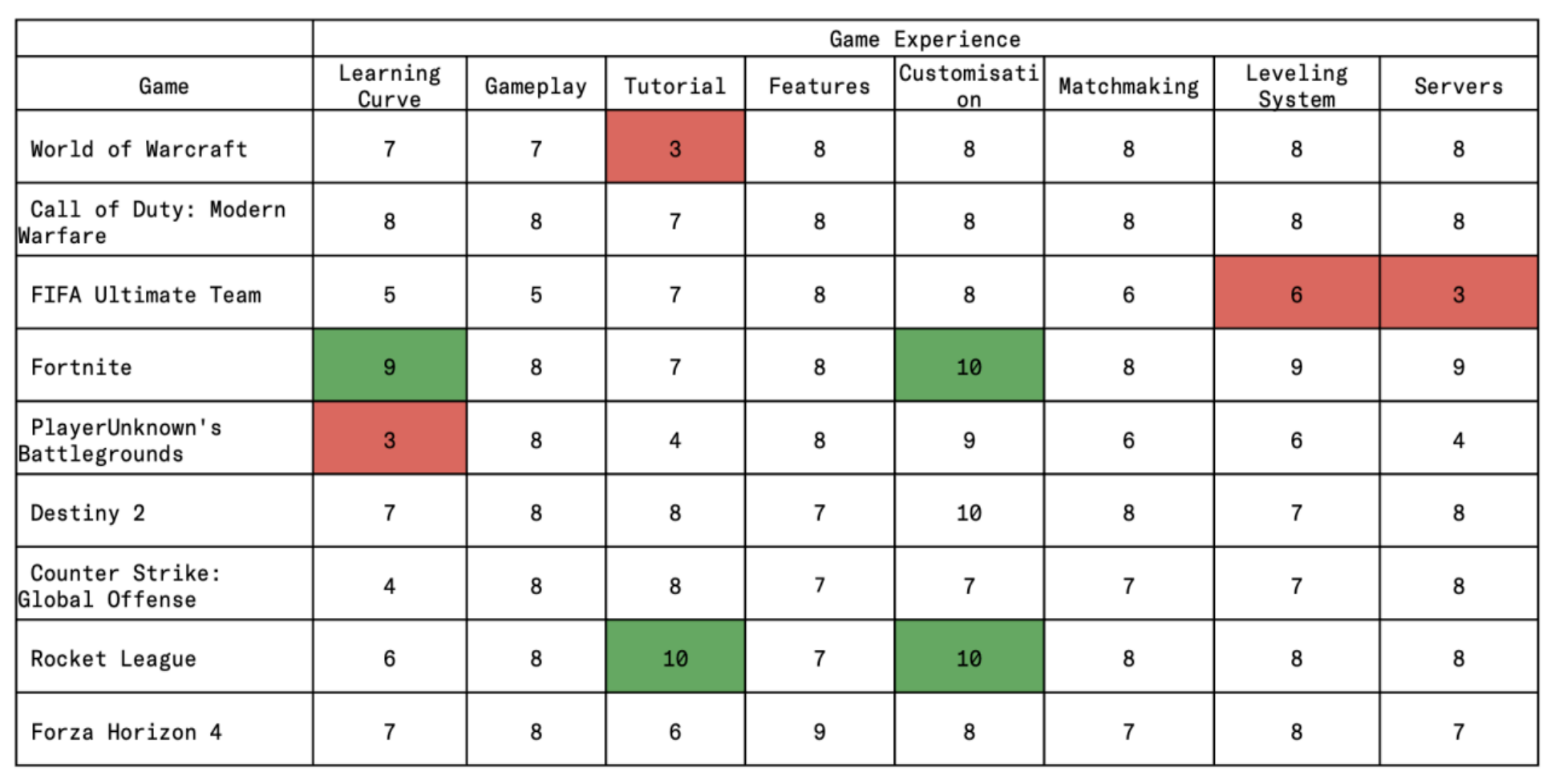

Benjamin Sagnier, Co-Founder of Drafted Management, conducted a study on user experience pain points across LSGs. From this study, Sagnier developed a chart that showcases different factors that impact player engagement across numerous LSGs and ranked popular games on a scale of 1-10 based on how much the game respected each factor. This chart compares some of the best performing LSGs and games that aren’t performing as strongly. The chart depicts key factors that directly impact retention, allowing developers to take inspiration from other games or companies who might be outperforming them in different areas.

Overall, developers are struggling with learning curves that impact new player acquisition or those of a lesser skill level, as well as technical issues with servers, both of which affect the playability of a game. If not mitigated, these pain points have the potential to increase the likelihood of a player disengaging or moving to another game. Mitigation strategies can include enhancing in-game customization for players, a key preference that more developers are implementing into their games to boost uniqueness and game differentiation in the oversaturated LSG market. We took these key performance indicators (KPIs) and how different games and companies were performing into consideration to identify a baseline standard of player preferences and best inform our research. The figure below depicts KPIs for numerous LSGs and displays how well or poorly leading games in the LSG space rank against one another.

Figure 1: User Experience Ratings (Sagnier, 2023)

Note: Ranked from 0-10 (10 being points of highest engagement and 0 being points of disengagement).

Despite market exhaustion and increased development costs, a survey by The Game Development Report revealed that 547 studios globally are either currently working on or maintaining an LSG (Game Development Report 2023, n.d.). In the past year, several LSGs have failed, including “EA cancel[ing] Apex Legends Mobile and a Battlefield mobile game” and “Square Enix shut[ting] down a Dragon Quest title in early 2023” (Francis, 2023). However, the potential for profitability and popularity in the LSG space have triumphed over the evident risks, and developers are continuing to produce LSGs.

The success of popular titles such as Fortnite, Minecraft, and Roblox underscore the importance of community building as critical to player connectivity and retention; “[The] future of LSG is going in the direction of user generated content (UGC), enabling the creation of experiences for the people that play the game” (gaming executive, personal communication, February 2, 2024). Games built upon UGC thrive on the passion of dedicated players as they create unique renditions, or modifications, to complement the base game. The growth of gaming will be driven by community creators, hinting that the industry will need to embrace this shift and recognize that it will lead to better content for players and foster deeper engagement (Sorek, 2024).

The Impact of Microtransactions on Gameplay

As most of the top LSGs are F2P, developers have placed emphasis on microtransactions as the primary monetization model. This has led to companies prioritizing revenue over creativity, and the pursuit of profitability has sacrificed better gameplay experiences for players (Snegiev, 2023). From the inception of a game, “developers are considering integrating loot boxes, time gates, and in-game currencies to encourage players to spend more” (Snegiev, 2023, para. 17). In 2023, “U.S. consumers spent $57 billion on video games which included all game content, from DLCs, microtransactions, and subscriptions” and “the vast majority of consumer spending — $48.0 billion or 84% — went towards content” (Fragen, 2023, para. 5). Microtransactions have largely been introduced to offset rising development costs. In 2016, popular title Grand Theft Auto 5, by Rockstar Games, made over $500 million on microtransactions alone, nearly 100% of their profits (Kayes, 2016). The majority of LSGs are reliant upon microtransactions as they offer a steady stream of income and dependency beyond the initial game launch (Makuch, 2018).

High-budget titles have underperformed, leading to numerous game discontinuations. One attribute to these games shutting down may be monetization fatigue that overwhelms players to keep up with new content purchases of in-game boosts or battle passes to unlock in-game content with every new season. “Microtransactions are the lifeblood of F2P service games, but it's easy for them to invite backlash, too” (Mercante, 2022, para. 14). In June 2022, Activision Blizzard’s aggressively monetized release of the F2P game, Diablo Immortal, was estimated to cost $500,000 to optimize the performance of a single in-game character (Winslow, 2022). Although players are not obligated to participate in microtransactions, it has become evident that if players want to progress further in a game, they’ll have to spend their way to success and pay-to-win (P2W) (Thompson, 2023).

What we have seen in successful LSG game releases from 2023-2024 is a growing distance from microtransactions. Arrowhead Game Studios’ February 2024 release of HELLDIVERS 2 was priced at $39.99, well below the average price point of $69.99, increasing accessibility. Likewise, the studio stated that if the game had followed the traditional model of microtransactions then consumers may have turned away, but the difference in the experience that the game offered was not easily dismissed (Brosofsky, 2024). Additionally, HELLDIVERS 2 offering players a free battle pass with an optional purchase for a premium pass that did not contain the advantage of skipping tiers (levels) played a big part in “community progression,” showcasing fair and equal gameplay (Brosofky, 2024).

Conclusion

In 2023, U.S. gaming consumers spent a total of $57 billion on microtransactions (Fragen, 2024). While microtransactions have increased earnings, rising consumer expectations demand developers to address “the ever-worsening microtransactions and the rampant failure to provide good content and make the changes that players have wanted for years” (Breslin, 2024, para. 6). However, successful releases of LSGs in 2023-2024, such as HELLDIVERS 2, are leading a new era of LSGs that balances profitability and high-quality gameplay with player-centric strategies.

As the market continues to saturate, game developers are finding it difficult to sustain players. Factors such as alternative game titles, or an overload of content has fatigued players and time constraints have affected game consumption habits. These attributes make it more difficult to commit to even one title, with the overarching sentiment being that “all these online titles cannot coexist, and the industry may want to change direction to avoid a costly mistake” (Borman, 2023, para. 1). The industry has hit a saturation point over the past few years and is at a crossroads where the pursuit of profitability conflicts with the need to provide captivating gameplay.

In Part II, this study explores successful marketing game campaign elements and analyzes interview and survey results to provide actionable insights.

-

ActivePlayer.io. (2024, March 22). Dragon’s dogma 2 live player count & statistics (2024). The Game Statistics Authority : ActivePlayer.io. https://activeplayer.io/dragons-dogma-2/

Aura (Outfit). (n.d.) Fortnite Wiki. https://fortnite.fandom.com/wiki/Aura_(Outfit)

Bankhurst, A. (2023, November 5). Fortnite Just Had Its “Biggest Day” Ever Thanks to Fortnite OG With Over 44.7 Million Players. https://www.ign.com/articles/fortnite-just-had-its-biggest-day-ever-thanks-to-fortnite-og with-over-447-million-players

BG Games. (2023, August 16). Gaming communities: The rise and impact of gaming communities on the world of video games. Medium. https://bggames.medium.com/gaming-communities-the-rise-and-impact-of-gaming-com munities-on-the-world-of-video-games-1fec152f649f

Black, S. (2024, January 10). Apex Legends players fed up with game’s “Poor” state as it bleeds users. Dexerto. https://www.dexerto.com/apex-legends/apex-legends-players-fed-up-with-games-poor-sta te-as-it-bleeds-users-2469889/

Borman, M. (2023, July 17). Gaming’s live-service focus will have to face the reaper sooner or later. Game Rant. https://gamerant.com/live-service-games-how-many-cannibalize-time-money-gameplay/

Breslin, R. L. (2024, January 11). Gamers are begging publishers to put single-player stories over live-service. GAMINGbible. https://www.gamingbible.com/news/gamers-begging-publishers-single-player-over-live-s ervice-948999-20240111

Brosofsky, B. (2024, March 2). Helldivers 2 proves live-service games aren’t the real problem. ScreenRant. https://screenrant.com/helldivers-2-life-service-game-pvp-microtransactions-cost/

Campbell, K. (n.d.). The power of player feedback: Why listening to your community is key… Testify. https://www.gotestify.com/resources/the-power-of-player-feedback-why-listening-to-your -community-is-key-to-game-development-success

Carson, O. (2024, March 12). Understanding user-generated content in gaming. PubNub. https://www.pubnub.com/blog/understanding-user-generated-content-in-gaming/

Chaundy, D., Ebanez, K., & Stojković, A. (2024, March 1). Most played games in 2024, ranked by average monthly players. Twinfinite. https://twinfinite.net/features/most-played-games/

Chung, S. (2023, March 30). Live service games are exhausting. IGN. https://www.ign.com/articles/live-service-games-are-exhausting

Clement, J. (2024, March 6). Steam annual game releases 2024. Statista. https://www.statista.com/statistics/552623/number-games-released-steam/

Comparably. (2022). Riot games competitors | comparably. https://www.comparably.com/brands/riotgames?__cf_chl_tk=AGy8_9qRJkNATMXcZYo zqX5xN.vRECFbrw_Ly1EsAZQ-1714439850-0.0.1.1-1621

Diaz, A. (2023, November 8). Fortnite OG is super weird as a Zero Build player. https://www.polygon.com/23952544/fortnite-og-map-zero-build-impressions

Dong, A. (2023, October 3). How riot games is cementing its spot in esports and beyond. https://www.fastcompany.com/90957925/riot-games-esports-arcane

Eloking. (n.d.). Season: What is a season in Valorant and League of Legends? https://eloking.com/glossary/general/season

EY. (n.d.). Competition that helps gaming companies innovate. https://www.ey.com/en_us/insights/media-entertainment/what-s-possible-for-the-gaming industry-in-the-next-dimension/chapter-1-competition-that-helps-gaming-companies-inno vate

Focus. (n.d.) Fortnite Wiki. https://fortnite.fandom.com/wiki/Focus

Fragen, J. (2024, February 7). U.S. video game spending stagnated in 2023, totaling $57.2B. VentureBeat. https://venturebeat.com/games/esa-circana-us-video-game-spend-57-2b-2023/

Francis, B. (2023, December 27). What the heck is happening with live service games?. Game Developer. https://www.gamedeveloper.com/business/what-the-heck-is-happening-with-live-service games

G2A.com. (2023, March 13). What is a battle pass and how does it work: A newcomer’s guide. G2A News. https://www.g2a.com/news/features/whats-a-battle-pass/

Game Development Report (2023). Retrieved March 3, 2024, from

https://griffingp.com/wp-content/uploads/2024/02/2023-Game-Development-Report.pdf

Garrity, T. (2022, November 9). Can Ted Lasso save EA Sports?. InsideHook. https://www.insidehook.com/culture/ted-lasso-ea-sports

Gresham, P. (2023, May 19). Live services: Is the success of the few clouding the strategic judgment of the many?. MIDiA Research.

https://www.midiaresearch.com/blog/live-services-is-the-success-of-the-few-clouding-the -strategic-judgement-of-the-many

Hardy, Q. (2016, July 13). Pokémon Go, Millennials’ First Nostalgia Blast. The New York Times. https://www.nytimes.com/2016/07/14/technology/pokemon-go-millennials-first-nostalgia -blast.html

Hurych, A. (2024, April 19). All upcoming video game release dates in 2024. TheGamer. https://www.thegamer.com/video-game-release-dates-2024/

I changed my name to “Beat me to win all my credits” in Rocket League & this insane trade happened! (2022, August 9). YouTube. https://www.youtube.com/watch?v=03UVjIsEVt8

Kaser, R. (2024, January 23). Subscriptions, live service games will slow down in 2024 | newzoo ... Subscriptions, live service games will slow down in 2024 | Newzoo. https://venturebeat.com/games/subscriptions-live-service-games-will-slow-down-in-2024 -newzoo/

Kayes, E. (2016, April 23). You won’t believe how much money GTA Online has made in microtransactions alone. FragHero. https://fraghero.com/you-wont-believe-how-much-money-gta-online-has-made-in-microt ransactions-alone/

Kennedy, J. (2023, December 17). 14 most tryhard skins in fortnite. TheGamer. https://www.thegamer.com/sweatiest-fortnite-skins/

Makuch, E. (2017, November 14). Microtransactions, explained: Here’s what you need to know. GameSpot. https://www.gamespot.com/articles/microtransactions-explained-heres-what-you-need-to/ 1100-6456995/

Mejia, O. (2024, January 30). Live service game sales were 73% of electronic arts (EA) Q3 2024 revenue. Shacknews. https://www.shacknews.com/article/138525/ea-q3-2024-earnings-live-service

Mercante, A. (2022, March 9). Live service game fatigue is real, but can it be fixed?. gamesradar. https://www.gamesradar.com/live-service-game-fatigue-is-real-but-can-it-be-fixed/

Merriam-Webster. (n.d.). Microtransaction definition & meaning. Merriam-Webster. https://www.merriam-webster.com/dictionary/microtransaction

Mills, M. (2024, March 1). Gaming industry layoffs: Key catalysts. Yahoo! Finance. https://finance.yahoo.com/video/gaming-industry-layoffs-key-catalysts-220125538.html?

Most Used Fortnite Skins. Fortnite.GG. (n.d.). https://fortnite.gg/most-used-skins

Naji, S. (2024, February 5). The quick death of new live service games. LinkedIn. https://www.linkedin.com/pulse/quick-death-new-live-service-games-sam-naji-horde/

Neese, C. (n.d.). Colan Neese | LinkedIn [Review of Colan Neese | LinkedIn]. LinkedIn. Retrieved March 3, 2024, from https://www.linkedin.com/in/colanneese/

Newzoo. (2023). Top public video game companies | by revenue | newzoo. https://newzoo.com/resources/rankings/top-25-companies-game-revenues

O’Connor, J. (2024, March 3). James O’Connor | LinkedIn [Review of James O’Connor | LinkedIn]. LinkedIn. Retrieved March 3, 2024. from

https://www.linkedin.com/in/jamesxiii/

Ogunnaike, A. (2024, March 4). How Many People Play Pokemon Go: A Look at the Player Count. Esports.net.

https://www.esports.net/news/pokemon/how-many-people-play-pokemon-go

Rathalos11. (2023, April 26). Some new information about Scattered Brains, Inc. https://www.reddit.com/r/oddworld/comments/12z9wrm/some_new_information_about_s cattered_brains_inc/

Reeves, B. (2023, December 28). Apex Legends player count dropped by almost 50% on steam this year. Dexerto.https://www.dexerto.com/apex-legends/apex-legends-player-count-drop-steam-2023-244 8933/

Removing player-to-player trading in December. (2023, October 10). Rocket League ® - Official Site. https://www.rocketleague.com/en/news/removing-playertoplayer-trading-in-december

Selway, J. (2023, November 14). The success of Fortnite og leaves the game in a tough spot. Game Rant. https://gamerant.com/fortnite-og-success-future-status/

Snegiev, S. (2023, November 9). The dying art of boredom in game design: The toll of monetization on creativity. HackerNoon. https://hackernoon.com/the-dying-art-of-boredom-in-game-design-the-toll-of-monetizatio n-on-creativity

Sorek, S. (2024, January 12). To mod or not to mod: Why the future of gaming is user generated. Game Developer. https://www.gamedeveloper.com/programming/to-mod-or-not-to-mod-why-the-future-of gaming-is-user-generated

Surf Witch. (n.d.) Fortnite Wiki. https://fortnite.fandom.com/wiki/Surf_Witch

Swan, C. (2022, September 26). Fortnite 5 Years Later - Becoming a Worldwide Phenomenon. Game Rant. https://gamerant.com/fortnite-5-year-anniversary-worldwide-phenomenon-epic-games-mas sive-success/

Tassi, P. (2023, November 10). Sony is cutting its PlayStation Live service calendar in half. Forbes. https://www.forbes.com/sites/paultassi/2023/11/09/sony-is-cutting-its-playstation-live-ser vice-calendar-in-half/?sh=1666fb132622

Taylor, D. (2023, November 23). Fortnite Creative’s Long Road Ahead. https://naavik.co/digest/fortnite-creative-read-ahead/

Taylor, M. (2024, January 23). Tekken 8 Review. PC Gamer. https://www.pcgamer.com/tekken-8-review/

Tekken 8 Live Player Count & Statistics (2024). The Game Statistics Authority : ActivePlayer.io. (2024, January 30). https://activeplayer.io/tekken-8/

“This is why rocket league content is dying.” | my thoughts as a large Rocket League Content creator. (2023, December 21). YouTube. https://www.youtube.com/watch?v=RmyciH4J8wg

Thompson, C. (2023, April 27). Capitalism is ruining video games. Mother Jones. https://www.motherjones.com/media/2023/04/asphalt-video-games-microtransactions-loo t-boxes-in-game-purchases-capitalism/

Valentine, R. (2020, December 1). Travis Scott reportedly grossed roughly $20m for Fortnite Concert appearance. GamesIndustry.biz. https://www.gamesindustry.biz/travis-scott-reportedly-grossed-roughly-usd20m-for-fortni te-concert-appearance/

Video game market (by type: Online, offline; by Platform: Computer, console, Mobile; by business model: Free-to-play, pay-to-play, play-to-earn) - global industry analysis, size, share, growth, trends, regional outlook, and forecast 2024-2033. Precedence Research. (n.d.). https://www.precedenceresearch.com/video-game-market

Wakeford, A. (n.d.). Wintertime wonders. Halo. https://www.halowaypoint.com/news/wintertime-wonders

Wakelin, J. (2024, January 16). Top 5 developments driving growth for video games. PwC. https://www.pwc.com/us/en/tech-effect/emerging-tech/emerging-technology-trends-in-the -gaming-industry.html

Winslow, L. (2022, June 27). Diablo immortal could run your Wallet way more than you thought. Kotaku. https://kotaku.com/diablo-immortal-build-microtransaction-legendary-gem-bl-184911288 4

Wirtz, B. (2023, September 7). The best and worst pay to win games. Video Game Design and Development. https://www.gamedesigning.org/gaming/pay-to-win-games/

Ziwei, P. (2020, December 2). Travis Scott reportedly earned $20million from “fortnite” event. NME. https://www.nme.com/news/music/travis-scott-earned-20million-fortnite-concert-event-2 829792

Zwiezen, Z. (2024, February 2). Over 500 studios are working on live-service games. Kotaku. https://kotaku.com/live-service-games-95-studios-destiny-suicide-squad-1851221959