By: Caitlyn Dour, Ethan Jones, Kailea Martin, Rachael McNamara, Sammie Paul, and Victoria Sprowls, researched as component of their MA in Entertainment Industry Management at Carnegie Mellon University. Their research was part of a capstone done in conjunction with Paramount Global Content Distribution.

Read Part 1 of this research here.

Image: Paramount

Image Source: Unsplash

Recap of Part 1

As the television space becomes increasingly saturated with content and streaming services, Paramount Global Content Distribution (PGCD) must find opportunities to both maximize revenue and increase the value of Paramount Global’s series in the streaming marketplace. Since the 2021 launch of Paramount Global’s streaming service, Paramount+, PGCD has been tasked with finding the best licensing strategy for Paramount Global content. To do so, PGCD must strike the appropriate balance between licensing content internally to Paramount+ and externally to other platforms. This Capstone project provides recommendations on how PGCD can remain competitive in streaming by maximizing both subscriber growth on Paramount+ and external licensing revenue. The study seeks to answer key research questions, such as how entertainment media companies evaluate content licensing deals, which factors impact audience retention on streaming platforms, and how PGCD can tailor licensing deals to strategically reach audiences that value specific content while increasing brand awareness. We examined the impact of major industry shifts, including mergers and acquisitions, streaming market crowding, and competition for consumer attention, on content licensing. To gain insights into audience content and platform preferences, content valuation, and branding strategies, we surveyed 576 US-based regular TV viewers online and interviewed industry professionals. Our survey and interviews with industry professionals indicate that studios with streaming services can retain subscribers by balancing licensing content in lucrative external deals and preserving brand-identifying content for their platform. Given our findings, we propose a two-step licensing strategy to help PGCD increase the value of Paramount content in the marketplace and entice new subscribers to Paramount+.

To provide PGCD with key insights and content strategy recommendations, the team investigated the following questions:

1. What are key factors consumers consider when subscribing to streaming platforms?

2. How should PGCD tailor licensing deals to strategically reach audiences that value specific content while increasing brand awareness?

3. Should PGCD continue externally licensing some of its most popular shows, or should it focus on retaining key content for Paramount+?

To answer these questions, our team completed a survey and interviews to better understand behaviors, wants and needs of those directly affected by streaming.

Review of Research Methodology: 2023 TV Preferences Survey

We conducted a survey to gather insights on how viewers value the services their SVOD platforms provide and the importance of TV series availability to subscribing or staying subscribed to an SVOD platform. In approximately a month, the survey reached 576 respondents. After filtering for persons who watch three or more hours of TV per week, we had 497 regular TV viewers for analysis. Quantitative survey data provided insight into audience engagement with content and platform and audiences’ value of Paramount-owned titles and franchises.

It is important to note that the survey respondents were likely skewed as the distribution channels were through personal paths, and as graduate students the age and viewing patterns likely reflect a skewed perspective to the data respondents. Overall, the following information is not demographically representative of all Paramount viewers.

Content Adventurers vs. Platform Loyalists

We asked each regular TV viewer in the survey to identify themselves as either a Content Adventurer (CA) or Platform Loyalist (PL) to understand how they perceived and defined their relationship between content and platform. The survey revealed that audiences’ relationships with content are stronger than with platforms. A substantial majority (85%) identified as CAs. CAs have an active approach to TV viewing, surveying many platforms to find a show they want to watch. They may even plan when to subscribe and unsubscribe from a platform based on content availability. This group outsized the 15% who identified as PLs, who may decide to watch a show because it is on their favorite platform. This “content first” behavior suggests that audiences are likely to follow content across platforms if it is something they want to watch. While nearly two-thirds of all regular TV viewers in our survey felt that access to series that fit their specific niches and interests was an important reason they stayed subscribed to their SVOD services, PLs demonstrated more interest than CAs in having an ecosystem of related content made available to them on their chosen platforms. PLs value access to many series that fit their specific interests, and only a third of PLs value having access to a wide variety of shows on their SVOD service of choice. Instead, 58% of PLs want to know they will be able to find something new to watch quickly, which is why they value having a content ecosystem - so the SVOD can quickly offer similar titles. Since PLs are more likely to stick to a few platforms and choose from the available content, they are more interested in being offered multiple titles with overlapping qualities that they can find easily and often.

Compared to PLs, CAs were less likely to prioritize finding their next show quickly, demonstrating preferences that seem to embrace the hunt for quality content. Only 39% of CAs care to find their next show quickly, but 54% desired access to a wide variety of shows in addition to exclusives and originals to keep their subscriptions ongoing. CAs may prove more challenging to retain once acquired, especially as, according to Variety’s VIP+ Report, the industry is likely to see a drop in the number of originals released for the first time since the streaming wars began (Dare to Stream, 2022). As certain studios look to profit from their investment in streaming platforms, overall growth in both licensed and original content spend is set to decrease from 6% in 2022 to 2% in 2023 (Satin, 2023). Despite this downturn in content spend growth, audience “streaming service consumption” is predicted to increase in 2023 (Nielsen, 2022, para. 2).

Paramount+ Audience Pipeline

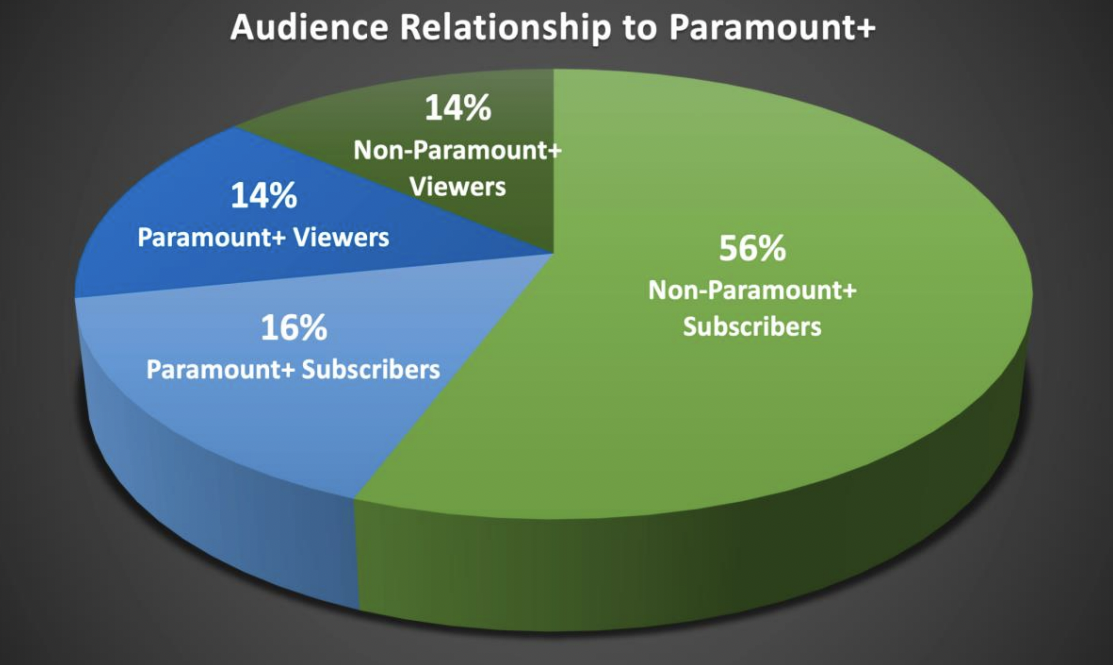

To build a clearer picture of Paramount Global’s audience’s specific TV preferences, grouped survey participants were based on their relationship to Paramount+:

(a) Paramount+ subscribers, respondents who own a Paramount+ subscription and need to be retained over time;

(b) Paramount+ viewers, respondents who access Paramount+, but do not own a subscription themselves. These consumers will likely be aware of Paramount Global's content, franchises, and offerings. As such, this is a group to target for conversion to subscription;

(c) Non-Paramount+ subscribers, respondents who own streaming subscriptions but do not subscribe to or have access to Paramount+. These consumers are less likely to be aware of Paramount Global's content, franchises, and offerings. This is a valuable group to analyze to determine the value of Paramount Global-owned franchises to license internally or externally;

(d) Non-Paramount+ viewers, respondents who have access to SVOD platforms that are not Paramount+ but do not own a subscription to even a single SVOD platform themselves. Figure 1 outlines the 497-person sample makeup via the Paramount+ audience pipeline.

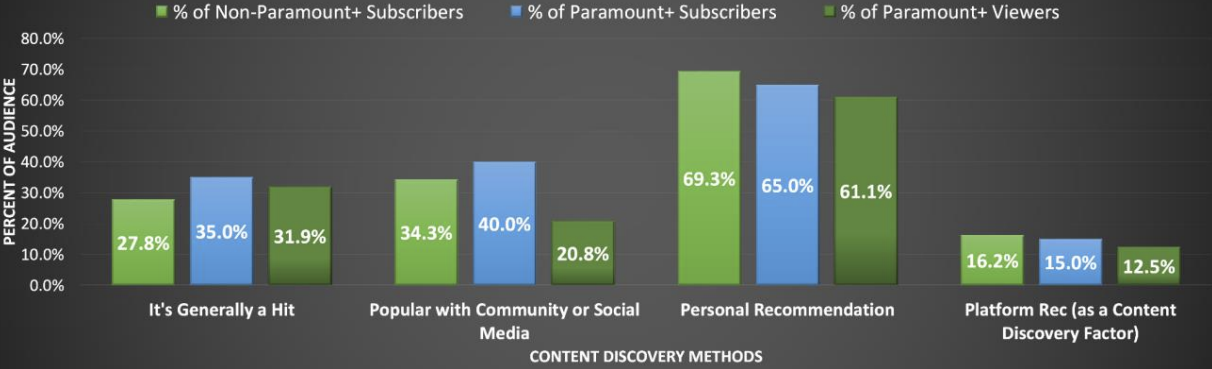

The following analysis will focus on Paramount+ subscribers, Paramount+ Viewers, and Non-Paramount+ subscribers. Across these groups, Figure 2 highlights that platform recommendations of new content are less important than other content discovery methods.

Image: Figure 1, Paramount+ Audience Pipeline, 2023

Image Source: Research Team

Image: Figure 2, Content Discovery Methods for the Paramount+ Audience Pipeline, 2023

Image Source: Research Team

On average, 65% of the Paramount+ audience pipeline demonstrated a higher likelihood to try out a new show when it was personally recommended by a friend, family member, or colleague. In addition, Paramount+ subscribers are more likely to watch a show perceived as widely popular or generally a hit than Non-Paramount+ subscribers (35% compared to 28%, respectively). Our findings differ from Nielsen’s, which found that 42% of audiences described platform recommendations as an important factor when they decide what to watch (Nielsen Audience Insights, Dec. 2022, p. 11). Given the difference between our findings and Nielsen’s, we supplemented our survey data with insights from a Principal Research Manager at Hulu (industry interview, February 4, 2023), who explained: “If [viewers] feel the service is providing good recommendations and gets them, then [the perception is positive]. But these days, there’s skepticism about whether the service is just pushing its new content or has consumer interest at heart.” Our findings suggest that platform recommendations are less important than word-of mouth or personal recommendations when audiences are discovering content. Library Content versus New Originals

While new, original series get the most word of mouth, legacy and “acquired programs that previously aired elsewhere” lead in total minutes viewed (57% of all minutes) on SVOD services (Nielsen Audience Insights, Dec. 2022, p. 7). Even though our survey respondents cite exclusives and originals as reasons they remain subscribed, viewers spend more time watching library titles. Figure 3 shows Paramount+ viewers are more than twice as likely to select exclusives and originals over having a wide variety of shows from which to choose as important. Since Paramount+ viewers are likely to access the platform via password sharing or through living in the same household as a Paramount+ subscriber, they may spend less time on the platform and therefore prioritize watching an original show getting great press or word of mouth.

Image: Figure 3, Catalog Offerings Importance Comparison for the Paramount+ Audience Pipeline, 2023

Image Source: Research Team

While library content plays an integral part in retaining audiences by entertaining them between original and exclusive premieres, we found that weekly windowing of new shows also plays a vital role. 46% of survey respondents who subscribed to at least one SVOD service prefer to watch each episode of the current series as they are made available. Nearly 20% of respondents indicated they watch current series either weekly or by waiting to watch 2-3 episodes a week during the show’s original run. The importance of original and exclusive content to retain audiences suggests that licensing agreements may increase in importance in the next five years as streamers look to bolster their services with unique series. In the survey, we explored audiences’ motivations to stay subscribed to SVOD services. Of regular TV viewers subscribed to at least one SVOD service, 61% said they keep their subscriptions to access specific titles or exclusive franchises. About a third of regular TV viewers felt that originals and exclusives were a primary reason they stay subscribed, and half consider them “somewhat important.” These survey results echo the ABC Signature Studios development team member’s opinion (industry interview, December 12, 2022) that streaming services should strategically provide viewers with rotating series offerings and library titles in the months when there are no new exclusive, original shows to maximize subscriber retention. Drawing from these observations, we considered what makes a show valuable to license externally. When we asked a Hulu Content Acquisition executive for her opinion (industry interview, December 9, 2022), she replied that not every piece of content is “brand-identifying” for an SVOD platform. While series labeled as originals or exclusives tend to be “brand identifying,” the executive expressed concern that these exclusive, original series significantly increase costs on company balance sheets for approximately a mere 13 episodes a year. PGCD should externally license content that inflates Paramount Global’s brand awareness in the overall marketplace without externally licensing titles that will disproportionately pull subscribers away from Paramount+ toward its competitors.

How Paramount Global Titles Track with Audiences

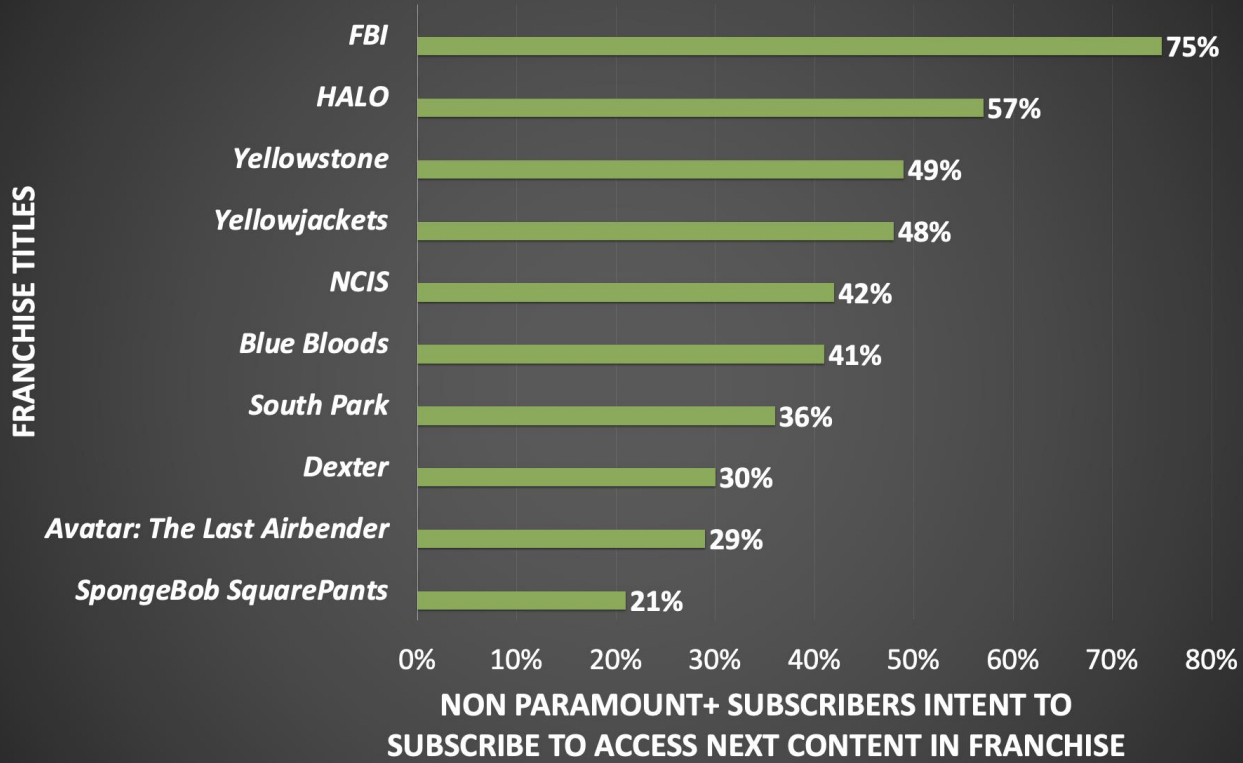

We also evaluated Paramount Global series when licensed internally to Paramount+ as “brand identifying” titles or licensed externally to other distributors. To determine this, we asked all Non-Paramount+ subscribers which Paramount Global-owned franchises they are currently watching or intend to watch when the franchise releases new content. Figure 4 tracks survey participants’ willingness to subscribe to Paramount+ if the next content in a popular Paramount Global show franchise was exclusive to Paramount+.

Image: Figure 4, Shows Non-Paramount+ Subscribers Would Follow to Paramount+

Image Source: Research Team

Paramount Global has a strong presence in the procedural drama space, and many of these legacy shows (e.g., FBI, NCIS) air first on linear via CBS. As PGCD searches out valuable titles to externally license, it may be worth questioning how many Paramount Global procedurals can, or should, live on Paramount+. While NCIS and Blue Bloods performed similarly in our study (42% and 41%, respectively), NCIS’s performance on Netflix (38 billion streamed minutes) in 2022 (Walsh, 2023) suggests it is well placed while licensed externally. Blue Bloods and FBI may be strong candidates to continue licensing internally from this analysis. Several other franchises we surveyed, like Dexter, Avatar: The Last Airbender, and South Park, have been available on other platforms. Dexter is available on Hulu, Avatar: The Last Airbender and its sequel, Legend of Korra, were licensed to both Amazon Prime Video and Netflix in 2020, and South Park was made available exclusively on HBO Max in 2019.

Survey participants demonstrated a strong interest in these franchises but, compared to other franchises, had a lesser intent to follow that franchise back to Paramount+. Roughly 1 in 3 Non-Paramount+ Subscribers would follow Dexter, Avatar, or South Park back to Paramount+ if the new content was released exclusively on Paramount+. More intriguing, our participants demonstrated interest in watching the Avatar franchise: 31% said they would watch the next Avatar content, outcompeting Yellowstone (13%) in general interest. With these insights as a foundation, PGCD may consider where an exclusive deal for Avatar content could draw the most monetary value with perspicacity. It is not a franchise to be licensed externally cheaply, given its high engagement rates and ability to attract subscribers. Fewer participants demonstrated interest in watching the next available content for other franchises, like FBI and HALO. However, those who did have enthusiastic intent to subscribe to Paramount+ to access them: 75% of participants who intend to watch FBI and 57% of those who intend to watch HALO indicated they would follow the series to Paramount+. Top drama series Yellowstone and Yellowjackets had more overall interest in watching and high intent to subscribe to access. Yellowstone and Yellowjackets are attractive enough to nearly 50% of Non- Paramount+ subscribers to entice them to subscribe to Paramount+ to access.

Given participant interest, Paramount+ should focus on internally licensing these titles or subsequent original spin-offs and sequels to drive continued retention and acquisition of subscribers. Digital analytics from Hub Entertainment Research revealed that of the 29% of their survey respondents who had seen the original Yellowstone series on CBS or Peacock, 70% had viewed at least one other episode of another Taylor Sheridan series on Paramount+, including 1883, 1923, Tulsa King, or Mayor of Kingstown (Hub Research Entertainment, 2023). That most Yellowstone fans sought out other Taylor Sheridan content on Paramount+ highlights viewer willingness to follow franchises cross-platform. Of participants, 21% of Paramount+ subscribers noted that the Yellowstone universe made subscribing to Paramount+ worthwhile. As Paramount Global embraces the successful franchising of Yellowstone, monitoring current Paramount+ subscribers’ franchise interactions will be imperative to mirror this success (Clark, 2023).

Key Title Takeaways

Due to viewer willingness to travel cross-platform, PGCD can expect audiences to follow high-value shows to Paramount+. Dexter, NCIS, and Avatar may be valuable library content to license externally, while Yellowjackets, Yellowstone, FBI, and HALO may be valuable exclusively licensed to Paramount+. In Chapter 4, we consider how PGCD can leverage our findings to strike a balance in licensing to increase brand awareness and acquire new subscribers.

final analysis

Entertainment media companies with streaming services must leverage licensing deals to maximize both revenue and subscriber growth. Our survey revealed which types of Paramount Global franchises are worth internally licensing to satisfy potential subscribers. The prevalence of CA behavior among survey respondents indicates that external licensing deals could provide PGCD opportunities to entice viewers to subscribe to Paramount+. Given our findings, we have developed a licensing strategy for PGCD to implement over the next five years.

Recommendations for the Future: A Two-Part Approach

As Paramount Global desires to be more competitive in the television and streaming space, we propose a two-step licensing strategy to help PGCD increase the value of Paramount Global content in the marketplace, boost brand awareness among consumers, and convert new subscribers to Paramount+.

Step 1: Licensing to Maximize Content Value

As the television space becomes increasingly saturated with content, PGCD needs to find opportunities to increase the value of its series in the marketplace. Our interviews with industry professionals in Global Distribution and Content Acquisition indicated two key elements to consider with every licensing deal: the potential revenue from the deal and the viewership that a piece of content can get on the platform where it is licensed. Together, those key elements create a piece of content’s total value to the license holder. For media companies with studios and streaming services, like Paramount Global, it is challenging to pinpoint the revenue that a piece of content garners from internal licensing deals. The best approximation for revenue is measuring subscriber growth and viewership during a series’ release period on the service. Paramount+’s subscriber base is growing significantly–the service gained 9.9 million subscribers from September 2022 to December 2022 (Dellatto, 2023). However, the platform’s total number of subscribers as of March 2023 is 60 million across the 28 countries where Paramount+ is available (Stoll, 2023b), compared to Netflix’s 230.8 million global subscribers (Dellatto, 2023) and 75 million U.S. subscribers (Stoll, 2023c). Paramount+’s subscriber growth appears promising and indicates growing consumer interest in the streaming service and its content. It is essential to recognize the potential viewership and, therefore, the potential value that a high-subscription platform could provide Paramount Global content.

To boost the overall value of Paramount Global content in the marketplace, PGCD should prioritize external licensing deals with top-performing streaming platforms like Netflix and Prime Video. Prioritizing external licensing deals with high-subscriber services in the next 2-3 years (until approximately 2026) will give the company opportunities for increased revenue and allow Paramount Global content to reach more viewers. The higher the viewership of a piece of content, the more value it can bring Paramount Global in the long run. That is, PGCD can leverage the viewership rates of its content to make more lucrative external licensing deals for the same content in subsequent licensing deals and international markets, increase brand awareness, and entice viewers to subscribe to Paramount+. While Paramount Global content is widely successful in the market, considering shows like NCIS, South Park, and Yellowstone, PGCD should seek opportunities to better utilize the subscriber base of other streaming platforms to swing the attention back to its brand. In addition to increasing the value of Paramount Global content, the emphasis on external licensing deals with high-subscriber streamers in Step 1 will provide PGCD the opportunity also to boost awareness of its brand in the marketplace. An SVP of Content and Consumer Insights at NBCUniversal Entertainment Networks (industry interview, February 15, 2023) described the impact that licensing a show to a high-subscriber streamer can have on brand awareness: a media brand can see “a big pop in awareness once [one of its shows] is put on Netflix.” The surge in awareness for a media brand after one of its shows is licensed to Netflix is called “The Netflix Effect” (Koblin, 2019). Titles that have benefitted from the “Netflix Effect” include Paramount Global’s own Schitt’s Creek and Avatar: The Last Airbender (Noble, 2022). Due to Netflix’s large subscriber base, shows are more widely accessible to niche and broad audiences alike, which, with specific titles, results in a snowball effect of gaining a mass following.

One example of a Netflix licensing deal increasing a show's viewership (and therefore value) is Pop TV's deal to license Schitt’s Creek to the streaming giant. As a direct result of Pop TV’s decision to externally license Schitt’s Creek to Netflix, the show gained critical acclaim and was even “No. 1 on Nielsen’s list of top 10 most-streamed shows in the U.S. for the week of Sept. 28” in 2020 (Schneider, 2020, para. 2). Pop TV used the momentum from Netflix’s viewership ratings to boost its brand. After the show's first two seasons were made available on Netflix, viewership of the third season on Pop TV grew by 28% (Adalian, 2020b). The season finale accumulated 1.3 million total viewers, and when Pop TV released the documentary special Best Wishes, Warmest Regards: A Schitt’s Creek Farewell solely on Pop TV, it became the highest-rated telecast in the network’s history (Petski, 2020). Schitt’s Creek’s breakout success on Netflix and our qualitative research indicate that externally licensing content to a high subscriber count streaming service like Netflix adds value to the show through increased viewership and popularity among consumers. Streaming services with large subscription bases can launch series into the cultural zeitgeist and increase viewership and brand awareness. Given the prevalence of CA behavior among survey participants, PGCD should prioritize external licensing agreements to extend the viewer reach of its premium (“A” tier) content. With wider viewership, shows can garner more critical and cultural buzz and create larger fanbases. Buzz and fandom will make the content more valuable to Paramount Global when the company focuses on internally licensing “A” tier shows.

Step 2: Leveraging Licensing Deals for Brand Awareness and Paramount + Growth

Once PGCD has successfully increased the value of its content through viewership and consumer trust in the brand, we recommend that the company leverage the marketplace value of its content to begin prioritizing internal licensing deals to feature premiere Paramount Global shows on Paramount+.

An immediate course of action that Paramount Global has already successfully done with South Park and Yellowstone is creating specials and spin-off series exclusively for Paramount+. In 2023 alone, there will be a new season of 1923, the new series Lioness, another new series Bass Reeves, another season of Yellowstone, and another brand-new Yellowstone universe series (Adalian, 2023). This spin-off strategy helps create monetary value from IP and allows PGCD to build brand awareness at the same time. The 85% of our survey respondents who identified as CAs indicate that consumers are willing to go to various streaming services to access the content they find interesting. The prevalence of CA behavior suggests that consumers tend to value content over platform, which bodes well for a distribution strategy that prioritizes external licensing in the short-term and internal licensing in the long term. Our survey data implies that most consumers may be willing to follow “A” and “B” tier series and franchises from external platforms to Paramount+. While a licensing strategy that prioritizes external licensing deals before internal deals may seem counterintuitive, our survey data indicates that Paramount Global currently needs a series with more of a loyal and dedicated non-subscriber audience to translate into a significant boost in subscriptions. Delaying internal licensing deals in the short term for shows that could gain high viewership on other platforms will allow Paramount Global content to become essential viewing to more consumers.

Other media conglomerates have seen success with this type of licensing strategy that prioritizes external deals first. For example, in 2021, NBCUniversal effectively leveraged the popularity The Office gained on Netflix to boost subscriptions to its streaming service, Peacock. In 2020, The Office was the most-watched show on any streaming service in the U.S., with Americans streaming over 57 billion minutes of the series in that year alone (Spangler, 2021). The size of Netflix’s subscriber base launched the show into the cultural zeitgeist, and the show had a larger reach in the longtail than when it aired on linear TV. Immediately after The Office moved from Netflix to Peacock on January 1, 2021, Peacock saw more subscriptions than when the service launched in April 2020 (Alexander, 2021). The increase in subscriptions Peacock saw when it became the exclusive home for The Office illustrates the merit of externally licensing “A” tier shows to high-subscriber streamers in the short term and the value of internally licensing those shows in the long term. Emily In Paris is an MTV Studio show initially developed for Paramount Network. Commencing production in August 2019, the first season of Emily in Paris was fully filmed before the COVID shutdown, making it a particularly valuable show. However, shifts within “ViacomCBS’s Entertainment and Youth Group’s approach to developing and programming content” (Adalian, 2020a, para.2) highlighted that Emily in Paris’s “best chance for long-term success was not on Paramount Network but on a streaming platform” (Adalian, 2020a, para.4) due to its projected lack of resonating with linear audiences. At the time of these deal discussions, Paramount Global had not launched Paramount+, so the show was licensed to Netflix and branded as a Netflix Original. When the show premiered, it immediately gained a massive following and has maintained substantial viewership for its three seasons. The show’s third season garnered 117.6 million hours of viewing time in its first week on Netflix (Campione, 2022). By bringing the show to Netflix, MTV could immediately give the show a large audience but still own the long-term rights and the underlying IP, allowing Paramount Global to develop and internally license potential spin-offs.

We recommend that PGCD begin leveraging the cultural value of its content and franchises to prioritize internal licensing deals for its premium, “A” tier content. In the second step of this proposed licensing strategy, the company should continue to license content it considers “B” and “C” tier out to services where it can be easily accessible to high levels of viewers. Licensing lower-tier shows to high-subscriber services could help launch those shows into the cultural zeitgeist and ultimately boost Paramount Global’s brand awareness.

Conclusion

The state of streaming has evolved rapidly over the past five years, and we expect these rapid changes to continue through 2028 and beyond. Since 2020, many media companies have been tightening production budgets and slashing company costs wherever they can for the sake of profit, and the streaming business unit has been a significant victim. As profitability, not solely subscriber count and viewership, becomes the key to streamer success, content licensing will remain an essential business strategy (Baine, 2022). Paramount Global has key content that could become successful and popular in the zeitgeist if licensed to streamers with a broader reach and gain increased market value. Prioritizing external licensing and increasing the value of Paramount Global content for 2-3 years offers the company a robust path to financial stability and growth. After building content value and viewership in the marketplace, Paramount Global will be in a strong financial position to capitalize on the fans gained from licensed content and convert them to loyal Paramount+ subscribers. As the value of Paramount Global content increases, streaming platforms, including Paramount+ and the company’s Free Ad-Supported Streaming Television (FAST) service, Pluto TV, will continue to grow Paramount Global’s scope and enrich brand perception among consumers.The entertainment business is famously challenging to understand and predict, and no perfect method exists for creating the most successful television licensing model. Given PGCD’s opportunity to connect with large audiences through strategically timed external and internal licensing deals, the company is in a great position to continue creating, supporting, and distributing content that entertains, educates, and inspires audiences across the globe.

-

Adalian, J. (2020a, July 13). Netflix swipes Emily in Paris from Paramount Network. Vulture. Retrieved February 29, 2023, from https://www.vulture.com/2020/07/emily-in-parisdarren-star-netflix.html

Adalian, J. (2020b, April 7). The unlikely rise of Schitt's Creek. Vulture. Retrieved April 7, 2023, from https://www.vulture.com/2020/04/schitts-creek-netflix-pop-success-story.html

Adalian, J. (2023, March 2). The (other) man behind the Yellowstone Kingdom. Vulture. Retrieved March 3, 2023, from https://www.vulture.com/article/chris-mccarthyparamount-yellowstone-interview.html

Alexander, J. (2021, Feb. 23). Are the office and friends bets paying off for Peacock and HBO Max? The Verge. Retrieved April 7, 2023, from https://www.theverge.com/22297077/theoffice-friends-peacock-hbo-max-streaming-wars-disney-plus-star

Alexander, J. (2022, Oct. 31). Peacock Curiosity, Paramount's future, & the great streaming rebundling. Puck. Retrieved January 29, 2023, from https://puck.news/peacock-curiosityparamounts-future-the-great-streaming-rebundling/

Baine, D. (2021, Dec. 27). How many streaming services can people consume? Ott Services & vMVPDs continue to soar. Forbes. Retrieved April 6, 2023, from

https://www.forbes.com/sites/derekbaine/2021/12/22/how-many-streaming-services-canpeople-consume-ott-services--vmvpds-continue-to-soar/?sh=36f9160331bb

Baine, D. (2022, Dec. 9). Streaming video services seek a balance between growth and profitability. Forbes. Retrieved April 3, 2023, from

https://www.forbes.com/sites/derekbaine/2022/12/09/streaming-video-services-seek-a balance-between-growth-and-profitability/?sh=8a8791a18763

Bell, B. (2022, Dec. 15). Nielsen streaming top 10: ‘Nope’ debut and ‘Yellowstone’ library push Peacock to a big week. Variety. Retrieved February 4, 2023, from

https://variety.com/2022/tv/news/nope-debut-yellowstone-library-peacock-big-weeknielsen-streaming-1235462821/

Bloom, D. (2022, Oct. 20). As Netflix pushes quantity, they can't forget quality matters more to viewers, UTA data suggests. Forbes. Retrieved January 30, 2023, from

https://www.forbes.com/sites/dbloom/2022/10/19/while-netflix-pushes-quantityfigurequality-matters-more-to-most-viewers-uta-data-suggests/?sh=20320fa714a5

Campione, K. (2022, Dec. 27). 'Emily in Paris' Season 3 debuts at no. 2 on Netflix Top 10; 'glass onion' reigns over film list. Deadline. Retrieved March 3, 2023, from

https://deadline.com/2022/12/emily-in-paris-season-3-glass-onion-netflix-ratings1235207291/

Clark, K. (2023, Feb. 24). Here's why the 'Yellowstone' franchise model works: Paramount. Home. Retrieved March 3, 2023, from https://www.paramount.com/news/global-contentcapabilities/heres-why-the-yellowstone-franchise-model-works

Cook, S. (2022, Oct. 6). 50+ Netflix statistics & facts that define the company’s dominance in 2023. Comparitech. Retrieved February 4, 2023, from

https://www.comparitech.com/blog/vpn-privacy/netflix-statistics-factsfigures/#:~:text=Netflix%20has%20over%2017%2C000%20titles,it%20offered%20in%2 0January%202018

Dellatto, M. (2023, Feb. 17). Paramount gains subscribers as Disney+ reports losses: Where all the major streaming services stand. Forbes. Retrieved March 1, 2023, from https://www.forbes.com/sites/marisadellatto/2023/02/16/paramount-gains-subscribers-as disney-reports-losses-where-all-the-major-streaming-services-stand/?sh=69f8e228c4ac.

Doyle, G. (2016). Digitization and Changing Windowing Strategies in the Television Industry: Negotiating New Windows on the World [Abstract]. Television & New Media, 17(7), 629–645. https://doi-org.cmu.idm.oclc.org/10.1177/1527476416641194

Fletcher, B. (2022, Nov. 2). Paramount+ adds 4.6M global subs in Q3, expects to raise prices. Fierce Video. Retrieved February 4, 2023, from

https://www.fiercevideo.com/video/paramount-adds-46m-global-subs-q3-expects-raise prices

Fletcher, B. (2023, Jan. 26). Comcast loses 419K cable subs, Peacock surpasses 20M in Q4. Fierce Video. Retrieved February 4, 2023, from

https://www.fiercevideo.com/video/comcast-loses-419k-cable-subs-peacock-surpasses 20m

q4#:~:text=Revenue%20at%20Peacock%20also%20jumped,dragged%20down%20NBC Universal%20quarterly%20earnings

Forristal, L. (2022, Aug. 4). HBO, HBO Max and Discovery+ report a combined total of 92.1M subscribers, plans for major restructuring. TechCrunch.

https://techcrunch.com/2022/08/04/hbo-hbo-max-and-discovery-report-a-combined-total of-92-1m-subscribers-plans-for-major-restructuring/

Gaughan, L. (2022, Dec. 22). Where are all those scrubbed HBO Max shows going? Collider. Retrieved February 4, 2023, from https://collider.com/where-are-hbo-max-shows going/#:~:text=Among%20the%20shows%20removed%20from,apparent%20to%20Gam e%20of%20Thrones.

Hamilton, C. (2022, Nov. 15). Why Paramount's streaming strategy places it in a precarious position: Charts. TheWrap. Retrieved March 3, 2023, from

https://www.thewrap.com/paramounts-streaming-strategy-analysis/

Hayes, D. (2023, April 12). Warner Bros Discovery confirms rebrand of HBO Max to Max; launch date set – update. Deadline. Retrieved May 7, 2023, from

https://deadline.com/2023/04/hbo-max-rebrands-as-max-streaming-warner-bros discovery-1235322516/

Horowitz Research. (2022, Dec. 12). Focus Generation Next. Horowitz Research. Retrieved February 5, 2023, from https://www.horowitzresearch.com/syndicated-research/focus generation-next/

Hub Research Entertainment. (2023, Feb.). 2023 EVOLUTION OF VIDEO BRANDING. Entertainment Marketing Research Reports & Media Industry Trends: Hub Research LLC. Retrieved April 6, 2023, from

https://hubresearchllc.com/reports/?category=2023&title=2023-evolution-of-video branding

Kastrenakes, J. (2014, Oct. 16). CBS becomes first major network to launch internet TV service. The Verge. Retrieved March 3, 2023, from

https://www.theverge.com/2014/10/16/6987543/cbs-all-access-streaming-service-no cable-required-launches.

Katz, B. (2021, April 8). Netflix and Sony get cozy with massive new licensing deal. Observer. Retrieved February 4, 2023, from https://observer.com/2021/04/netflix-and-sony-get cozy-with-massive-new-licensing-deal/

Koblin, J. (2019, Jan. 21). What made the TV show 'You' a hit? Netflix. The New York Times. Retrieved April 7, 2023, from

https://www.nytimes.com/2019/01/21/business/media/netflix-you-ratings.html

License Global (2020, July 1). NBCUniversal Snags ViacomCBS Content for Peacock. License Global. Retrieved February 4, 2023, from https://www.licenseglobal.com/streaming-and tv/nbcuniversal-snags-viacomcbs-content-peacock

Lu, G. (2023, Jan. 9). ‘Yellowstone’ prequel starring Harrison Ford breaks major viewership record. Boss Hunting. Retrieved February 4, 2023, from

https://www.bosshunting.com.au/entertainment/tv/yellowstone-1923-premiere-record viewership/

Maas, J. (2023, January 31). Showtime to be renamed 'Paramount+ with Showtime' as part of integration across linear, streaming. Variety. Retrieved May 7, 2023, from

https://variety.com/2023/tv/news/showtime-renamed-paramount-plus-with-showtime 1235506843/

Nielsen. (2022, June 27). Nielsen’s state of play report reveals that streaming is the future, but consumers are currently overwhelmed by choice. Nielsen.

https://www.nielsen.com/news-center/2022/nielsens-state-of-play-report-reveals-that streaming-is-the-future-but-consumers-are-currently-overwhelmed-by-choice/

Nielsen. (2022). (rep.). Audience Insights: A current view of the media landscape.

Noble, T. (2022, Aug. 29). The Netflix effect. Hollywood Branded. Retrieved March 1, 2023, from https://blog.hollywoodbranded.com/the-netflix-effect

Pallotta, F. (2022, Oct. 18). Netflix is back to growing after a nightmare year of losing subscribers. CNN. Retrieved February 4, 2023, from

https://www.cnn.com/2022/10/18/media/netflix-earnings/index.html

Paramount. (2022). Paramount global content distribution: Paramount. Paramount. https://www.paramount.com/brand/paramount-global-content-distribution

Petski, D. (2020, April 9). 'Schitt's Creek' finale draws 1.3 million viewers across pop, Comedy Central & Logo. Deadline. Retrieved March 1, 2023, from

https://deadline.com/2020/04/schitts-creek-finale-draws-1-3-million-viewers-across-pop comedy-central-logo-1202904042/

Sangari, N. (2022, Oct. 20). Percentage of US streaming households drops in Q3 while cable TV declines slowed. Percentage of US Streaming households drops in Q3 while cable TV

declines slowed. Retrieved January 29, 2023, from https://www.kantar.com/north america/inspiration/technology/percentage-of-us-streaming-households-drops-in-q3- while-cable-tv-declines-slowed

Satin, D. (2023a, January 3). Analysis: Content spending will slow in 2023 as streamers pivot to profitability; Disney, Netflix to lead way. The Streamable.

https://thestreamable.com/news/analysis-content-spending-will-slow-in-2023-as-streamers pivot-to-profitability-disney-netflix-to-lead-way

Satin, D. (2023b, April 4). Iger: Disney will consider licensing content, but Marvel, Star wars will stay in-house. The Streamable. Retrieved April 7, 2023, from

https://thestreamable.com/news/iger-disney-will-consider-licensing-content-but-marvel star-wars-will-stay-in-house

Schneider, M. (2020, Oct. 29). 'Schitt's creek' rises, as season 6 floods Nielsen's streaming top 10 list at no. 1. Variety. Retrieved March 1, 2023, from

https://variety.com/2020/tv/news/schitts-creek-season-6-netflix-nielsen-weekly streaming-rankings-1234818927/

Spangler, T. (2021, Jan. 29). 'The Office' was by far the most-streamed TV show in 2020, Nielsen says. Variety. Retrieved April 7, 2023, from https://variety.com/2021/digital/news/the office-most-streamed-tv-show-2020-nielsen-1234883822/

Spangler, T. (2023, Feb. 1). NBCUniversal shuts off Peacock Free Tier for new users. Variety. Retrieved March 3, 2023, from https://variety.com/2023/digital/news/peacock-ends-free tier-nbcuniversal-1235508588/

Stoll, J. (2023a, Jan. 27). Number of sign-ups and monthly active accounts to the video streaming platform Peacock in the United States from December 2020 to 4th quarter 2022. Statista. Retrieved February 4, 2023, from https://www.statista.com/statistics/1246902/number sign-ups-peacock-united

states/#:~:text=As%20of%20the%20fourth%20quarter,the%20fourth%20quarter%20of% 202021

Stoll, J. (2023b, May 5). Number of Paramount Plus subscribers worldwide from 1st quarter 2021 to 1st quarter 2023. Statista. Retrieved May 7, 2023, from https://www-statista com.cmu.idm.oclc.org/statistics/1211543/paramount-plus-subscribers-worldwide/

Stoll, J. (2023c, April 20). Number of Netflix paying streaming subscribers in the United States and Canada from 1st quarter 2013 to 1st quarter 2023. Statista. Retrieved May 7, 2023, from https://www-statista-com.cmu.idm.oclc.org/statistics/250937/quarterly-number-of netflix-streaming-subscribers-in-the-us/

Tran, K. (2022, Oct. 5). A large content library will only get you so far in the streaming wars. Morning Consult. Retrieved January 30, 2023, from

https://morningconsult.com/2022/06/29/streaming-services-content-library/ VIP+ Variety Intelligence Platform. (2022). (rep.). Dare to Stream (Sixth). Variety.

ViacomCBS announces completion of the merger of CBS and Viacom. Business Wire. (2019, December 4). Retrieved April 8, 2023, from

https://www.businesswire.com/news/home/20191204005844/en/

ViacomCBS Staff. (2022, Feb. 15). Viacomcbs unveils new company name, Global Content Slate and international expansion plans for paramount+ at investor event: Paramount. Paramount. Retrieved March 3, 2023, from

https://www.paramount.com/press/viacomcbs-unveils-new-company-name-global content-slate-and-international-expansion-plans-for-paramount-at-investor event#:~:text=NEW%20YORK%2C%20Feb.,a%20new%20parent%20company%20nam e

Wallenstein, A. (2023, Feb. 15). Exclusive survey: What Hollywood really thinks of Netflix's password crackdown . Variety. Retrieved March 3, 2023, from

https://variety.com/vip/exclusive-survey-what-hollywood-really-thinks-of-netflixs password-crackdown-1235522818/

Walsh, S. (2023, Jan. 26). Which Netflix show was the most streamed of 2022?. Vanity Fair. Retrieved February 4, 2023, from,

https://www.vanityfair.com/hollywood/2023/01/which-netflix-show-was-the-most streamed-of-2022

Zorrilla, M. (2021, Dec. 21). TV Ratings: ‘1883’ Has Biggest Debut for New Show on Cable Since 2015. Variety. Retrieved May 3, 2023, from,

https://variety.com/2021/tv/news/1883-yellowstone-ratings-1235141015/